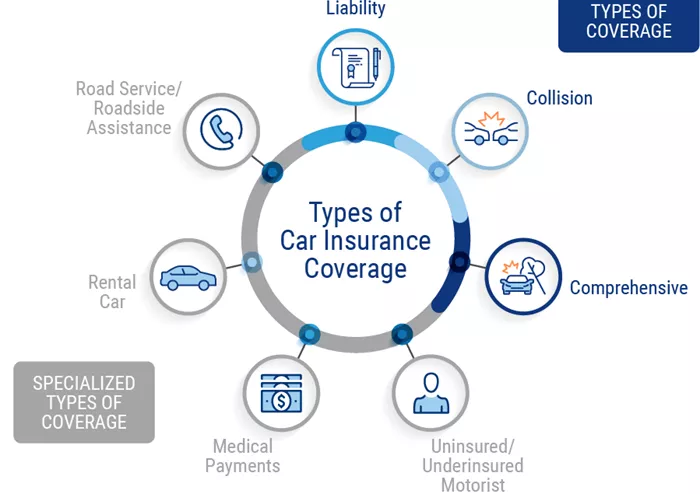

As someone who’s spent years in the automotive industry, I’ve seen firsthand how confusing auto insurance can be. With so many terms and types of coverage, it’s easy to feel lost. But knowing what different kinds of auto insurance cover is crucial. It’s the difference between being fully protected on the road and facing unexpected financial headaches. Let’s take a deep dive into the world of auto insurance coverage.

Liability Insurance: The Legal Must – Have

Liability insurance is the foundation of auto insurance in most places. It’s required by law in almost every state or region, and for good reason. This type of coverage pays for damages and injuries you cause to other people and their property if you’re at fault in an accident.

There are two main parts to liability insurance: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and even legal fees if the injured party sues you. For example, if you rear – end another driver and they end up in the hospital, this coverage will help pay their medical bills. Property damage liability, on the other hand, pays for repairs or replacement of the other driver’s vehicle and any other damaged property, like a fence or a mailbox you hit.

It’s important to note that liability insurance only covers the other party. It doesn’t pay for your own vehicle’s damage or your medical expenses. That’s why many drivers choose to add other types of coverage to their policies.

Collision Coverage: Protecting Your Vehicle in Accidents

Collision coverage is all about taking care of your car when it’s involved in an accident. Whether you hit another car, a tree, a pole, or even roll your vehicle, this coverage kicks in to pay for repairs or replace your car if it’s totaled.

Let’s say you’re backing out of a parking spot and accidentally hit a parked car. Collision coverage will cover the cost of fixing the damage to your vehicle, minus your deductible (the amount you agree to pay out of pocket before insurance kicks in). The same goes if you’re in a head – on collision or a sideswipe.

Keep in mind that collision coverage doesn’t care who’s at fault. Even if the other driver caused the accident, your collision coverage can pay for your car’s repairs. However, if the other driver has insurance and is at fault, your insurer may try to recoup the money from their insurance company.

Comprehensive Coverage: More Than Just Accidents

Comprehensive coverage is like a safety net for all the things that can go wrong with your car that aren’t related to a collision. This includes theft, vandalism, fire, hail, floods, and even damage from hitting an animal.

Imagine you park your car on the street overnight, and when you come out in the morning, you find that someone has broken into it and stolen your stereo. Comprehensive coverage will pay to replace the stereo and fix any damage to the car caused by the break – in. Or, if a hailstorm damages your car’s paint and dents the body, this coverage will take care of the repairs.

One thing to remember about comprehensive coverage is that it also has a deductible. So, you’ll need to pay that amount first before your insurance company covers the rest of the cost.

Personal Injury Protection (PIP) and Medical Payments Coverage: Taking Care of You and Your Passengers

Personal Injury Protection (PIP) and Medical Payments Coverage (MedPay) are designed to pay for medical expenses for you and your passengers after an accident, regardless of who’s at fault.

PIP is more comprehensive. It can cover not only medical bills but also lost wages if you can’t work because of your injuries, rehabilitation costs, and even childcare expenses if you’re unable to take care of your kids due to the accident. In some states, PIP is mandatory, while in others, it’s an optional add – on.

MedPay, on the other hand, is more focused on medical expenses. It pays for things like hospital stays, doctor visits, surgeries, and dental work related to the accident. It’s a simpler form of coverage compared to PIP but can still be very helpful, especially if you don’t have health insurance or if your health insurance has high deductibles.

Uninsured/Underinsured Motorist Coverage: Protection Against Other Drivers Without Enough Insurance

Despite insurance being mandatory, not everyone follows the rules. Uninsured/Underinsured Motorist Coverage steps in when you’re in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover your damages and injuries.

This coverage can pay for your medical expenses, lost wages, and property damage. For example, if you’re hit by a driver who has no insurance and you end up with a broken leg, uninsured motorist coverage will help pay for your medical treatment. Underinsured motorist coverage works in a similar way but is used when the at – fault driver’s insurance limits aren’t enough to cover all your losses.

Conclusion

Understanding what each type of auto insurance covers is the first step in building a policy that works for you. Consider your driving habits, the value of your car, your financial situation, and the risks you face on the road. Don’t be afraid to ask questions and shop around. Different insurance companies may offer different combinations of coverage and prices. By taking the time to understand your options, you can drive with confidence, knowing that you’re protected no matter what comes your way.