As Southern California struggles to recover from the devastating wildfires of January, the financial impact continues to climb. Losses have reached an estimated $250 billion—well beyond early predictions. But that figure doesn’t include residents who lost uninsured homes and businesses.

According to data analytics firm CoreLogic, just two fires—the Palisades and Eaton—are expected to lead to as much as $45 billion in insurance payouts. However, these payments only benefit those who had insurance coverage in place.

Extreme weather used to be rare. Now, it’s the new norm. As wildfires, hurricanes, floods, and storms grow more frequent and intense, homeowners face growing difficulties when it comes to getting insured.

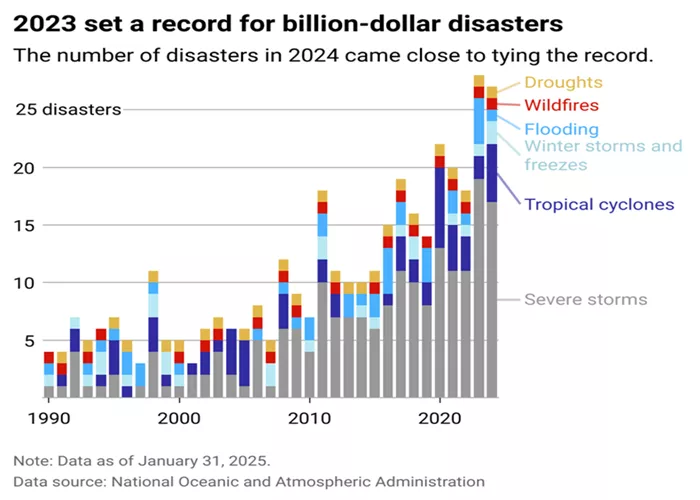

In 2023 alone, the National Oceanic and Atmospheric Administration (NOAA) recorded 28 separate billion-dollar climate or weather disasters in the U.S.—a record-breaking number. The damages from just the first nine months of that year totaled $57.6 billion. Experts blame climate change for the rise in both frequency and severity of these events.

In response, insurance companies have raised rates across the board. The Bipartisan Policy Center noted in June that property insurance prices have risen every quarter since late 2017. Auto insurance has also surged. In Colorado, premiums jumped 52% from 2013 to 2023 due to blizzards, tornadoes, and hail. In Florida, hurricanes caused an 88% increase in the same period, according to The Washington Post.

A new study from CheapInsurance.com, using NOAA data, reveals just how serious the impact is on the U.S. insurance market.

Big Insurers Back Away From High-Risk States

To protect their bottom lines, major insurance providers are pulling out of high-risk areas. In 2023, both Allstate and State Farm stopped offering new home insurance policies in California due to wildfire risks. In states like Louisiana and Florida, many insurers have exited altogether because of rising hurricane damage.

As of February 2025, the average annual home insurance rate in the U.S. is $2,258. That’s slightly lower than the previous year, but rates vary widely by state, home size, age, and location. Nebraska, Florida, and Oklahoma currently face the highest premiums in the country.

Severe weather continued to pound the U.S. throughout 2023. In August, Hurricane Idalia swept through Florida, Georgia, and the Carolinas, causing $3.5 billion in damages. 2024 began with powerful tornadoes and high winds along the East Coast, adding $1.8 billion more in losses. The year ended in devastation, with Hurricanes Helene and Milton striking the Southeast. Combined, they caused an estimated $300 billion in damage and claimed 250 lives.

Insurance Gaps Are Widening

As natural disasters become more common, insurance markets are shrinking. This is especially true in disaster-prone states like Florida and California, where major companies are reducing or ending service altogether.

To address the issue, Florida has created the Hurricane Catastrophe Fund and Citizens Property Insurance Corporation to help make coverage more affordable. However, these funds are draining quickly, and the state may not be able to keep up with future demand.

California has chosen a different approach: the state restricts how insurers calculate rates by allowing them to assess only the past 20 years of risk data. But this method may not reflect current and future threats. Many companies have refused to operate under these restrictions.

Finding Long-Term Solutions

Experts agree that insurance, while essential, is only a temporary solution. States must do more to prepare for and recover from climate-related disasters. Without stronger disaster planning and prevention strategies, even the best insurance policies won’t be enough.

Some states are starting to seek new answers. In Oregon, new laws aim to create more transparency between insurers and homeowners. The goal is to help people identify risk and secure better coverage for mitigation efforts like fireproofing homes or reinforcing roofs.

These types of partnerships could provide a path forward as the U.S. confronts the growing risks of climate change. But until stronger, long-term strategies are in place, Americans—especially in vulnerable regions—may find it harder than ever to get the protection they need.