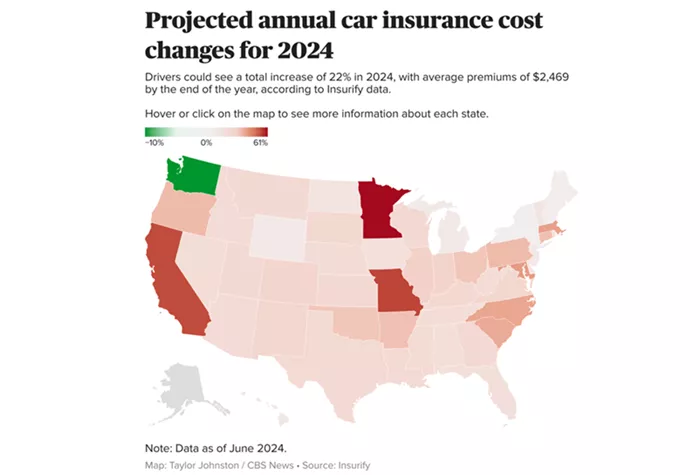

A new report signals bad news for U.S. car owners as auto insurance rates continue to rise. For 2024, drivers in three states may see their premiums increase by up to 50%. This follows a trend of higher insurance costs, which have been a significant contributor to inflation in recent years.

The report, published by Insurify, a company that tracks auto insurance data, projects a 22% increase in the average U.S. car insurance policy this year, raising it to $2,469 by the end of 2024. This increase comes after a 24% jump in 2023, according to the report.

The states expected to see the biggest spikes in premiums are California, Minnesota, and Missouri. Drivers in these states could face rate hikes of 54%, 61%, and 55%, respectively.

Auto insurance rates remain a major concern for consumers, particularly after two years of elevated inflation. While the overall inflation rate has eased—dropping to 2.9% in July, the first time it’s fallen below 3% since March 2021—drivers are still grappling with rising premiums. A key factor driving this trend is the increasing frequency and severity of climate-related events, which are causing more vehicle damage.

“Increasingly severe and frequent weather events are driving up auto insurance premiums,” the Insurify report explains. “Hail-related auto claims accounted for 11.8% of all comprehensive claims in 2023, up from 9% in 2020, according to CCC Intelligent Solutions.”

The Most Expensive States for Car Insurance

As of June 2024, Maryland has the highest average auto insurance premium in the U.S., with full coverage costing an average of $3,400 per year. Insurify forecasts a 41% increase in the state’s rates, bringing the average to $3,748 by the end of the year. South Carolina follows closely, with an average policy premium of $3,336 in June, and rates are projected to rise by 38%, reaching $3,687 by year’s end.

Why Are Rates Increasing?

Several factors are contributing to the rise in auto insurance rates. Aside from climate events, the costs for vehicle repairs have surged. The price of labor and parts has risen more than 40%, and insurers are passing these higher costs onto drivers. Additionally, the increasing involvement of lawyers in accident claims is driving up settlement amounts, which in turn raises insurance premiums.

Drivers Are Skipping Claims to Avoid Rate Hikes

As rates continue to climb, many drivers are changing their behavior. A recent survey from LendingTree found that 4 in 10 insured drivers who have been involved in an accident have chosen not to file a claim with their insurance provider. Of those who did file a claim, 25% later regretted their decision.

Drivers who opted not to file claims cited various reasons. Some felt the damage was too minor, while others had deductibles higher than the repair cost. A significant portion of drivers—42%—avoided filing because they didn’t want their premiums to increase.

Rob Bhatt, an auto insurance expert at LendingTree, explained, “Once you’ve been involved in an accident, insurance companies consider you a higher risk to insure. Your rates will eventually go down if you avoid claims for three to five years, but you’ll face financial strain until then.”

Despite the potential rate hikes, Bhatt advised that it’s usually better to file a claim if the cost of repairs exceeds your deductible by a significant amount. “The whole point of having car insurance is to protect yourself from financial hardship after an accident,” he said.

Conclusion

Car insurance rates are expected to rise sharply in 2024, particularly in California, Minnesota, and Missouri. These increases are driven by a combination of climate-related damage, rising repair costs, and the involvement of lawyers in accident claims. Drivers should be aware of these trends as they navigate their insurance options in the coming year.